Current Solar Incentives Arizona

Other incentives for solar accelerated depreciation.

Current solar incentives arizona. Charging customers who purchase qualified residential charging equipment between january 1 2018 and december 31 2020 may receive a tax credit of up to 1 000. Residential arizona solar tax credit. In the past some states with otherwise lousy policy had tremendous incentives that drove down the up front cost of going solar so much that. The credit is allowed against the taxpayer s personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1 000 maximum allowable limit regardless of the number of.

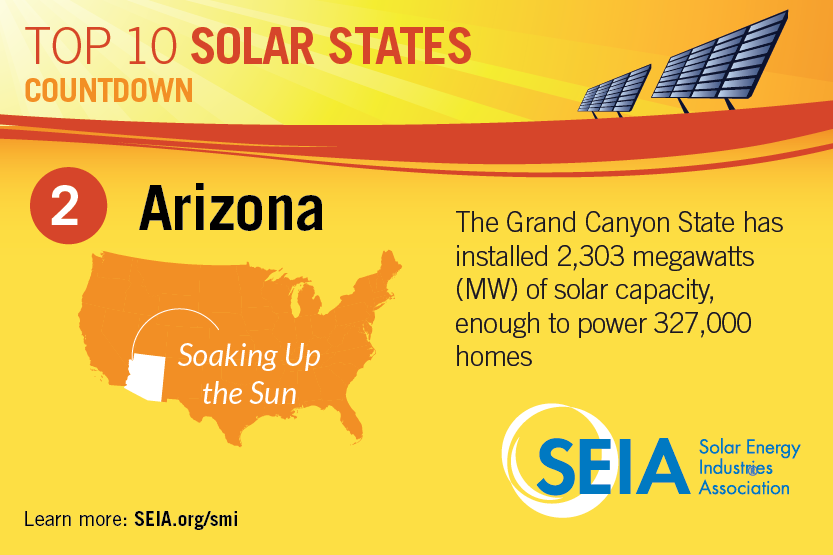

1 so it s no surprise that it consistently ranks in the top 10 solar states in the u s. In states like arizona you can now get a 5 kw solar system for under 10 000 after incentives. Arizona s solar energy credit is available to individual taxpayers who install a solar or wind energy device at the taxpayer s arizona residence. New york offers a state tax credit of up to 5 000.

Arizona and massachusetts for instance currently give state income tax credits worth up to 1 000 toward solar installations. As one of the sunniest states in the country arizona is a paradise when it comes to solar power. We bring the experience and buying power of over 1 000 installations to get you the absolute best price possible. Solar panel costs have come down due to technological improvements and increased competition between solar companies.

Current solar incentives and tax credits available in phoenix. There are several arizona solar tax credits and exemptions that can help you go solar. Next to high electricity prices and net metering solar incentives have traditionally been the most important factor for whether home solar power makes financial sense in a state. That is a significant amount of savings on your income taxes.

At universal solar direct we work directly with you to customize a solar power solution to meet your specific needs. We are an arizona solar installation company with our offices in phoenix conveniently located near scottsdale. The top rated arizona solar tax credit and state incentives. Arizona s solar energy credit is equal to 25 of the costs of a solar system up to 1 000.

However in 2020 the solar scenario has changed completely and solar is a lot cheaper and more profitable than people think. Thanks to accelerated depreciation businesses can write off the value of their solar energy system through the modified accelerated cost recovery system macrs which reduces businesses tax burden and accelerates returns on solar investments qualified solar energy equipment is eligible for a cost recovery period of five years. The 26 federal solar tax credit explained.